SIP Trunk sales growth is slipping so will this have a negative impact on the sales of SIP phones and, in an already highly competitive market, further increase pressure on vendors and distributors?

SIP has evolved over time to the point where many consider it has become a commodity. As a consequence, and as its popularity grew, and its benefits understood the market became driven by cost with resellers shifting to the lowest price.

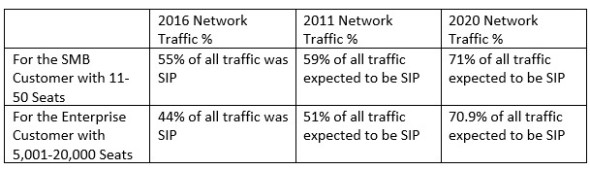

Worldwide, the SIP Trunk market displays solid and steady growth (see graph) amongst both Enterprise and SMB organisations.

However, and according to analyst firm Cavell Group, the UK SIP Trunk market is seeing a marked slowdown in the SME sector as providers seek out cloud comms services to drive up the ARPU with other bundled services.

One such service is obvious; the UK hosted VoIP market now exceeds 3million users making the UK the leader in Europe in terms of numbers of Hosted VoIP users and leading many commentators to think the unthinkable – that hosted telephony is growing at a faster rate than SIP trunks despite (or because of?) the approaching cessation of ISDN in 2025.

This phenomenon could of course just be attributed to a numbers game, or put more bluntly, it’s more a case of who’s got the most feet on the ground. The UK SIP trunk market is largely in the hands of only 2-3 large providers whereas there are some 90+ hosted telephony service providers, most of whom are highly active.

Cavell, the industry analyst with a strong focus on these markets, makes a very interesting point here when they say that they believe the slowdown in SIP is also due to that 2025 ISDN turn off date set by BT, which they say is too far in the future to make an impact on the market today. European ISDN Turnoff dates are in much more aggressive timeframes and are having a greater impact on buying behaviour. As a result, most UK providers have focussed on Hosted VoIP rather than SIP Trunking. Cavell speculate that the SIP Trunking market would boom and grow if BT was proactive and started to migrate some of its ISDN base to IP.

SIP Phones

It’s a phone, just a phone. Just because it’s an IP phone is no longer that significant, is it? Well, no. Two things really; firstly IP based networking and communications is pretty much ubiquitous these days and secondly, it’s an ‘end-point’ not a phone.

Only those with at least a few grey hairs will remember the bad old days of vendor proprietary lock-in when it came to hooking any device or application up to their equally proprietary PBX systems. That’s why we call them ‘legacy’. IP has swept away all those protective and restrictive markets with an open standard IP broom that was so finely exampled by the recent acquisition of Polycom by Plantronics.

Not so long ago that news would have been headlined by ‘Headset vendor purchases Video Conferencing firm’. Such is the market dynamics of today and the rate of change taking place in our sector that the current headline would be more accurate if it read, ‘Plantronics Creates New End-Point and Collaboration Giant’.

By selling Polycom now, owner Siris Capital Group gets a decent short-term return without having to worry about the impact of Cisco with the BroadSoft base, what Microsoft is doing with Lenovo, and whether Logitech is moving up-market. Siris did what all good private equity firms do, and that's take the money and not look back.

Looking ahead, Polycom's portfolio complements Plantronics perfectly and vice versa, and the deal can jump start the company into that UC market.

Zeus Kerravala, the founder and principal analyst with ZK Research, commented, “The most successful companies in the digital world will be the ones with the most data and the machine learning algorithms to interpret the data. The combination of Plantronics and Polycom can generate user and meeting specific data everywhere from the board room to huddle rooms to user desktops.”

This leads us quite neatly on to what Cisco are doing with their IP handsets in the wake of their recent acquisition of Broadsoft. Up till this point most Broadsoft platform based service providers had their own handset vendor relationships firmly established with the likes of Polycom, Yealink, snom and others. However, talking to Cisco at a recent Service Provider event in London it quickly became clear that this status quo was being set up by them for disruption.

Cisco now delineates their three series of phones as follows; 8800 Series - Premium, 7800 Series - Regular, and the 6800 Series which is ‘Tuned to European SP needs (Gigabit) and a cheaper price’. On top of this I was told a brand-new series of phones was expected to be launched in a few weeks but no detail was available on these devices.

The issue for channels is whether Cisco really get behind their own handsets on the Broadsoft platform and how their competitors and channel resellers react. At stake is a lot of the CAPEX in what is generally regarded as an OPEX hosted telephony deal.

With SIP seemingly being driven by price is it therefore valid to ask if the same could be said for SIP handsets or do feature sets and quality play a significant role.

According to Ian Brindle, Head of UC Devices at Nimans, all these aspects are important.

“A combination of the three is driving the market further forward. Price tends to be the headline grabber with functionality and quality sitting just beneath, but once resellers enter into dialogue with their customers then the conversation soon moves into features.

The hosted market is growing at about 25% annually and this has enabled customers to adopt an Opex model instead of Capex via on-premise. This spans the whole market, SME, Mid-Market and Enterprise. Cost and flexibility are the driving factors. On a cost-per-seat basis users are not losing out on functionality. With on-premise there are annual maintenance costs too.

It is a quality-led market due to the type of platforms that this type of solution is being deployed on such as BroadSoft. There is still demand for on-premise IP but off-premise is where all the momentum is.”

Are SIP/IP Phones still tied in some ‘proprietary’ way to host phone systems and platforms?

Ian Brindle says, “Regarding on-premise IP telephony, to use all the feature-sets then these can only be generally accessed using the manufacturer’s proprietary range of SIP phones. Some functionality tends to be sacrificed. But in the hosted world there tends to be much more interoperability.”

In that case who has got the best IP phone integration to a hosted telephony platform and why?

The two main players in this arena are Polycom and Yealink who dominate the majority of the market. We’ve done our homework at Nimans and offer both. From a connectivity point of view there are few barriers but from a BroadSoft perspective it will not support devices without full interoperability testing.

Interoperability testing is very important. Resellers could fall into the trap of deploying SIP enabled devices but without full interoperability testing big problems are ahead. It’s paramount.

A new generation of SIP

Steve Glaister at Invosys questions with hosted so widely promoted, we must ask is there actually a future for SIP in today’s market - and what does that look like?

“As far as I’m concerned, the answer is yes, absolutely. It’s simply a different form of SIP – and it can be an attractive proposition.”

A spanner in the SIP works has actually been the announcement of the ISDN switch off, forcing British companies to seek an IP alternative.

Glaister says that this was swiftly followed by a surge in hosted telephony being pushed by many of the key players, often pitched as the only feasible option.

“It must be said that in most cases, transferring systems across to hosted is the obvious choice for customers requiring added functionality. But what about those use cases where additional functionality isn’t required and scrapping existing infrastructure isn’t on the cards?

Look at the distributor market. All too often, a hosted product simply isn’t a practical option for organisations. This simply comes down to the fact that hosted isn’t always a key part of the distributor’s existing business model. This is even more evident when distributors (or resellers) have previously sold physical systems into customers. These PBXs often have a long shelf life and there are few opportunities to replace or upgrade.

This is where a modern SIP offering comes into its own, providing a half-way house. Utilising existing call handling cloud software, and seamlessly attaching into a SIP product, the pre-routing and call manipulation becomes available before the call hits the PBX. The cost benefits are apparent with no per minute charge to receive calls for the end user.

Cloud IVR, cloud queuing, cloud area-based routing and many other services are instantly available in an unmetered environment. It’s no longer a cost per line saving, it is a feature rich solution sell, creating a Hybrid Cloud and OnSite PBX.

This combination offers the best of both worlds, along with additional security and insurance, something which hosted alone cannot do.

There are also scenarios where replacing the existing infrastructure simply isn’t an option. Take a large company with multiple sites, for example, who has plans to move in the next 12 months. You’ll be hard pressed to convince them to invest in new infrastructure now. Likewise, we’ve seen customers in listed buildings with tight restrictions on any alterations – even if they want a hosted solution, it is difficult to implement. For all of these customers SIP allows for multiple solutions to work together to bridge the gap.

The clear message from resellers and end users is that there is a demand for a product that offers the same functionality as hosted that they can use on their existing kit. At the same time, however, both groups still view hosted and SIP as competing products. What they really need is flexibility and the best solution for their business, be it hosted, SIP - or a combination of the two.

As innovators and the early adopters, Invosys understand this - yet we also realise that for our customers, embracing this new evolution of SIP is a learning curve. Where we excel is in helping bridge the gap to ensure both our resellers – and their customers – also arrive at this conclusion. In doing this, we can create an IP telephony solution no matter where the customer is on their telephony journey.”

Ed Says...

With over 90 VoIP service providers active in the UK it is inevitable that there will be both attrition and consolidation. We have already witnessed ‘market aggression’ in many forms as SPs fight their corners tooth and nail to win business. With the migration of users from one platform to another no simple feat, this will ultimately lead to a few tears and resellers must decide whether to stay safe with established providers or chase the generally bigger margins promised by new entrants.