Telco’s across the world need to transform their businesses. Shrinking revenues in voice and

data mean telcos need to change and develop new digital services. They are however facing

digital disruption with strong competition from new players.

For those that have been part of the telecommunications industry over the last 20 years it has been a wonderful ride. Extraordinary growth in fixed-line telecommunications from 1998-2001, as the internet developed, was followed by the explosion in mobile from 2002-2009.

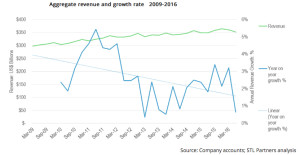

Since 2009, things have been rather different in most markets. Indeed, as the figure below shows, aggregate annual growth from the sixty-eight operators polled has fallen from over 5% in 2011 to a steady 2-3% from 2013 onwards with no signs of a strong rebound on the horizon.

In the face of shrinking revenues in voice and data it’s time for telco’s to transform their businesses but which operator growth strategies will remain viable in 2017 and beyond?

Analyst firm STL Partners says the days of meteoric growth are in the past, and telcos need to find a new approach to prevent a dramatic decline in their revenues.

This is not a new story; STL Partners has been writing about this phenomenon and the need for business model change since 2006. Of the seven different growth strategies that were used by telcos between 2009 and mid-2016 STL concluded that only one, which involves developing or acquiring new businesses and services, is viable for 2017 and beyond if the industry is to reignite sustainable growth.

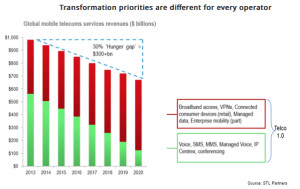

Digital services are an important part of this growth strategy. In fact, as our chart shows, STL Partners estimates that digital business should represent 25+% of Telco revenue by 2020 to avoid long-term industry decline.

However, the move to digital is difficult for telcos, who have traditionally relied on an infrastructure-based business model. Digital businesses are very different, and to be successful here telcos will need to make a fundamental shift from their traditional infrastructure-based business model to a complex amalgam of infrastructure, platform, and product innovation businesses.

One of STL Partners’ global observations is that all operators have different goals in the pursuit of transformation.

In the UK the decline of telco voice and data revenues reflects that of the world stage.

We tend to chart and comment upon these declines each August as Ofcom publish the data in their annual UK Communications Market Review (CMR) and in August 2015 we reported that the regulator observed 75% decline in the volume of fixed line minutes since 2004, 13% in the previous 12 months alone.

This August, whilst the decline trend was still present, Ofcom decided to be more positive in their outlook and their focus was not so much on stark market numbers but more on the trends. The Ofcom message is more one of the ‘traditional’ ways of communicating are giving way to new means and methods of communicating rather than top lining the numbers – although all the market statistics were all still there.

So, amongst the headlines this year was the news that 4G take-up had increased to 48% of UK adults, 37% of fixed broadband connections are providing actual speeds of 30Mbit/s and that 71% of all adults own a smartphone.

A key driver for the decline of traditional services has finally been pinned by Ofcom on the increasing use of ‘Over The Top’ (OTT) services in a number of market sectors.

We would caution B2B businesses to not dismiss this trend as being driven entirely by the 16-24 age cohort and not an issue for business users and suppliers.

Don’t dismiss the fall in fixed line and live TV viewing figures in favour of a Netflix induced rush to view an anytime, anywhere, any device OTT service as being a ‘So what? It’s just a Millennial Effect’ caused by under the under 30’s.

The ‘So what’ is important. All that Netflix – and 4k content is arriving daily, all those social media applications that we don’t understand let alone use, need that same stuff that your cloud based business applications do. They need bandwidth to work properly and provide a great user experience. And these groups of high bandwidth consumers are now competing with each other for the same resources.

If Ofcom is already looking to 5G as well as 802.11ac Wave 2 and 802.11ad as potential solutions to network congestion, then perhaps we should be looking too and certainly not be sitting back and thinking that 37% of fixed line broadband delivering 30Mbit/s is anywhere close to being an acceptable situation.

Since the publication of the Ofcom CMR further reports from the UK regulator have been released that shine further light on the state of play specifically within the broadband and mobile sectors.

So, Ofcom’s Connected Nation report of December 2016 can be summarised as follows.

The most important messages from Ofcom regarding Broadband were that over the course of 2016, the UK took another step forward in the coverage of its fixed and mobile communications. But it would be wrong to infer that the picture is universally a rosy one. For a significant number of consumers, and in many parts of the country, fixed broadband speeds are slow and mobile coverage is poor or indeed non-existent.

We would highlight the following from the report:

Superfast broadband coverage in the UK has improved significantly over the last few years. The coverage of superfast broadband has extended to over 25 million (or 89% of) UK premises, up from 83% in 2015. This creates the potential for better speeds and improved quality of service for both residential and SME consumers.

There are still gaps in broadband coverage. Progress has been made in reducing the number of premises that cannot get acceptable speeds. However, around 1.4 million, or 5% of, homes and small businesses in the UK are still unable to receive download speeds greater than 10Mbit/s. This represents the lowest number of premises that would fall within the UK Government’s proposed broadband Universal Service Obligation (USO), depending in its specification;

The growth in the number of premises taking up superfast broadband appears to be slowing. Over 9 million, or 31% of, UK premises now subscribe to superfast services, up from 27% in 2015 and 21% in 2014. While this latest year-on-year increase is a reasonable improvement, these figures suggest that growth in superfast take-up might be reaching a plateau. Given the relatively high levels of superfast coverage, it is unclear why more consumers are not actively taking up faster services.

Ofcom acknowledges that mobile services are playing an increasingly important role in our daily lives. This means consumers increasingly expect their mobile devices to work reliably wherever they are, whether at home, at work, or on the move with the key highlights of their report being:

4G roll-out: All four operators are in the middle of a major 4G rollout programme, which provides in some locations similar connection speeds to those of fixed networks. To date the rollout of 4G services has primarily focussed on providing higher speed services to users in cities and towns. As they are rolled out more widely, it is likely that 4G landmass coverage will continue to increase to at least match the coverage of earlier generation 2G and 3G services. Some operators have also enabled voice calling on their 4G networks, which together with voice over Wi-Fi, are helping to increase the number of places where consumers can make and receive voice calls.

Mobile data growth: In the past year, mobile data consumption per subscriber has grown at a rate of 49%. Although still growing, this is less than last year’s growth rate of 64%. It is almost identical to the data growth rate on fixed networks. The volume of data carried over mobile networks remains a small proportion (around 4%) of data carried over all networks.

More needs to be done to extend mobile coverage to all of the locations consumers want to use their mobile devices. There are two main reasons why additional steps are likely to be needed to meet future consumer expectations on mobile coverage.

Firstly, the additional coverage improvements resulting from commercial investments by mobile operators in new network infrastructure will reach a plateau.

Secondly, the existing geographic voice call coverage targets in licences, requiring 90% landmass coverage by the end of 2017, are based on lower mobile signal levels than those we have found to be necessary from our field testing work to deliver a good consumer experience. This means that when these targets are met, good geographic landmass coverage is likely to be below 90%.

We would add to this that increasingly the high availability of Wi-Fi results in a rapidly growing proportion of mobile data traffic being offloaded from the mobile carrier network to fixed line broadband.

Ed Says…

We live in challenging and changing times that affect almost every sector of the comms industry but no more so, in my opinion, the telco market. Darwin never actually said the fittest or the fastest would survive. What he said was that those that could adapt to change the best would be the survivors. This is great news for a channel that is used to handling change and is highly innovative in finding solutions.