The findings from recent research by IDC on cloud adoption is summarised by the phrase,

‘All are trying, some are benefiting; few are maximizing value’. Let’s see what that means.

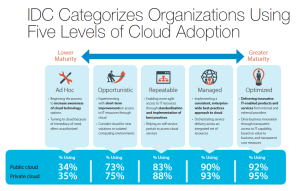

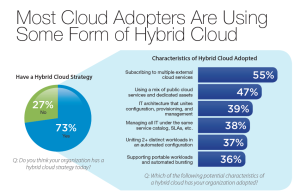

Cloud is the new normal – according to analyst firm IDC in the late 2016 research report, Cloud is mainstream. Their survey shows cloud adoption has increased 61% from last year, with 73% pursuing a hybrid cloud strategy and on-premises private cloud spending projected to increase by 40% over the next two years.

But, says the analyst firm, many still lack cloud maturity with only 31% pursuing Optimised, Managed, or Repeatable cloud strategies.

Obstacles to achieving greater cloud maturity include skill gaps, legacy siloed organisation structures and IT/LOB misalignment.

Significantly IDC notes that the greater the level of cloud maturity the better the level of business outcomes, including increased revenue and more strategic allocation of IT budget.

The most mature cloud organisations are defined by their use of DevOps, hybrid and multi-provider cloud, microservices (small, independent processes that communicate with each other to form complex applications which utilise APIs.), containers (e.g., Docker, a virtualisation method for running multiple isolated Linux systems on a single host), and cloud-based Internet of Things (IoT).

DevOps (development and operations) should be seen as significant. Fundamentally DevOps is an enterprise software development phrase used to mean a type of agile relationship between Development and IT Operations. The goal of DevOps is to change and improve the relationship by advocating better communication and collaboration between the two business units.

Putting that simply, it’s one enabler of the holy grail for a successful Digital Transformation - gaining competitive advantage. If this activity is absent from larger enterprises today then they are making themselves vulnerable to future digital disruption.

Traffic…

Last November, in their annual Global Cloud Index, Cisco projected that Cloud traffic to nearly quadruple and represent 92 percent of total data centre traffic by 2020.

This rapid growth of cloud traffic is attributed to increased migration to cloud architectures due to their ability to scale quickly and efficiently support more workloads than traditional data centres.

For the first time, Cisco also quantified and analysed the impact of hyperscale1 data centres. These data centres will grow from 259 in 2015 to 485 by 2020. Hyperscale (those with the architecture to scale appropriately as increased demand is added to the system) data centre traffic is projected to quintuple over the next five years. These infrastructures will account for 47 percent of total data centre installed servers and support 53 percent of all data centre traffic by 2020.

A key infrastructure trend is transforming data centres. Software-defined networking (SDN) and network functions virtualization (NFV) are helping to flatten data centre architectures and streamline traffic flows.

Over the next five years, nearly 60 percent of global hyperscale data centres are expected to deploy SDN/NFV solutions. By 2020, 44 percent of traffic within data centres will be supported by SDN/NFV platforms (up from 23 percent in 2015) as operators strive for greater efficiencies.

Pointedly it is noted that in the six years of the Cisco study, cloud computing has advanced from an emerging technology to an essential scalable and flexible part of architecture for service providers of all types around the globe.

Powered by video, IoT, SDN/NFV and more, Cisco forecasts this significant cloud migration and the increased amount of network traffic generated as a result to continue at a rapid rate as operators streamline infrastructures to help them more profitably deliver IP-based services businesses and consumers alike.”

What Are the Drivers?

Organisations will move to the cloud. Whether they have already started adopting cloud technology, are in the midst of planning to do so or can’t quite fathom the change just yet, it is inevitable at some point in the not so distant future.

But why is cloud adoption so inevitable? What’s driving organisations to make this move? There’s actually a strategic reason behind every cloud adoption effort, and identifying and prioritising reasons is important for channel resellers.

Comparethecloud.net says that when you boil it down, there are only six drivers for cloud adoption: Three business-focused drivers (business growth, efficiency and experience) and three technology-focused drivers (agility, cost and assurance).

Here’s what you need to know about each one:

Business Growth: is one of the top benefits organisations can realise as a result of cloud adoption. Based on how an organisation defines growth you then need to determine how cloud technology will help in that pursuit.

Efficiency: is an extremely common cloud driver, with 71% of organisations worldwide ranking it a top area they hope to approve through cloud technology. At its core, efficiency is about removing unnecessary steps to streamline processes in order to increase productivity or deliver on customer requirements faster. As a result, increasing efficiency also supports business growth, by increasing worker productivity, and experience initiatives, by fulfilling customer needs faster.

Customer Experience: Next among the business drivers is improving the quality of the customer experience, which 45% of enterprises worldwide rank as a top cloud driver (2015 Cloud Enterprise Report). Two of the most common ways organisations are achieving this goal with cloud technology are by introducing new channels of engagement and improving workplace productivity.

Agility: Improving IT agility, or enabling IT to be more responsive to business needs and react faster to market changes, is a top technology driver for 66% of organisations worldwide (See DevOps comment above). This goal is very attainable in the cloud environment, as SaaS technologies mean that IT no longer needs to be consumed with traditional application management tasks. Cloud technologies are also easier to enhance and swap out to accommodate changing business needs.

Cost: The cost driver has two sides: Reducing IT expenses and restructuring these expenses to spread them out over time thanks to the licensing model of SaaS technologies. While 39% of organisations do consider reducing IT expenses a key cloud driver cost generally takes a backseat to other cloud drivers as organisations typically choose to reinvest any savings to help achieve other goals, such as increased agility and improved experience.

Ed Says…

Before resellers begin any new cloud initiative with a customer it’s essential to identify which drivers are behind the decision to move to the cloud. Once you do, you also need to prioritise it against any other drivers you have identified as part of the strategy.