Comms Business Magazine talks to Knight Corporate Finance about the rise of private equity investments in the ICT sector and the flexibility they can offer business owners.

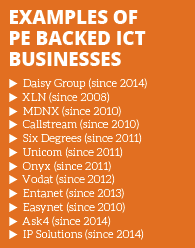

Shortly before Christmas London based IP Solutions became the latest ICT business to take an investment from private equity (PE). At the larger end of the spectrum and at the same time Daisy Group completed its’ de-listing from AIM as part of a PE backed transaction. The sector has been attracting serious attention from PE since 2010 and this shows no sign of abating. Over half of all transactions in the sector are either investments by PE, or trade sales to PE backed businesses.

Paul Billingham of Knight commented, “private equity is an option often ignored by business owners but it presents an interesting and rewarding alternative to a trade sale. Sometimes business owners want to de-risk by selling part of their business whilst still retaining a sizeable stake and on-going day to day control and PE can deliver this”.

Paul Billingham of Knight commented, “private equity is an option often ignored by business owners but it presents an interesting and rewarding alternative to a trade sale. Sometimes business owners want to de-risk by selling part of their business whilst still retaining a sizeable stake and on-going day to day control and PE can deliver this”.

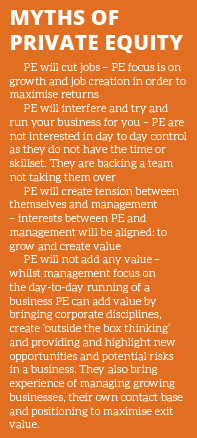

Whilst PE is often on the receiving end of adverse publicity in the mainstream press (see Phones4U and City Link) it is a flexible form of finance that is not very well understood by most people. Rather than being the destroyer of jobs, as it is often perceived, PE backed companies employ over 600,000 people (FTEs) in the UK and provide growth finance that would otherwise not be available.

Business owners looking to sell their business often do not consider PE as a genuine option as an exit route, and they are frequently surprised at the range of options it presents to them which are often more appealing than a straight trade sale or raising bank finance. PE effectively provides an alternative option to businesses looking for growth funding, a partial exit, or an outright exit. Sellers are often very surprised that PE can not only match trade buyers in terms of price, and as we’ve seen recently exceed trade buyers offers, but can also bring a degree of flexibility to tailor the deal to Vendors’ requirements.

Adam Zoldan of Knight commented, “One of the best examples of how successful PE can be in the sector is XLN. Manchester based Palatine initially supported an MBO in 2008, then sold it to ECI in 2010, and then to Blackstone in 2014, its third PE partner. Each one so far has made a healthy return and retained the original management”.

As is typical in PE deals, management have been rewarded with ‘sweet equity’, which is used by PE houses to incentivise management to grow the business and gives management a greater stake in the business.

Paul Richards of recently PE backed IPS commented, “Private equity was not something that we had considered but once we understood more, we realised that this was aligned with our own personal objectives, enabling us to realise value and allow us to build the business to a level that would probably not be achieved without external investment.”

There are over 500 private equity houses in the UK and everyone has its own unique set of investment criteria. Laura Cockburn of Knight added, “Having come from a PE background myself I recognise that ICT businesses will receive lots of interest given the strong growth, high levels of recurring revenues and the emergence of high growth converged and unified communications solutions in the market. We look forward to working on more PE deals in the sector this year.”

There are over 500 private equity houses in the UK and everyone has its own unique set of investment criteria. Laura Cockburn of Knight added, “Having come from a PE background myself I recognise that ICT businesses will receive lots of interest given the strong growth, high levels of recurring revenues and the emergence of high growth converged and unified communications solutions in the market. We look forward to working on more PE deals in the sector this year.”

Billingham concludes, “We are still seeing a tremendous amount of interest from PE in the sector entering 2015 and we expect numerous PE led deals this year.”