|

The scenario is familiar to all of us: the mobile phone market is saturated. And now it seems the economy is doing badly, so discretionary purchases like mobile phones are likely to suffer. So how do you make money? The answer: data. And that means online services and applications - -the saviour of the mobile phone industry.

The simple conclusion is that if there are so many good high-spec phones around, then the services they open up are the way to get them and the more data-intensive packages moving.

Graham Jelfs, marketing director for Advantage Cellular Communication, believes the consumer market has itself become a factor in building expectations for the corporate buyer. “In the past businesses were a lot more motivated by getting absolutely the best deal for their business, ensuring they weren’t paying over the odds, whether in terms of the bundle they were on or for other elements that would impact the bill,” he says. “I think, though, that there’s been an impact from a variety of issues within the mobile market as a

whole.”

The various deals on offer in the market have made life more difficult, he adds. Reports of mis-selling have undermined confidence, which is a fundamental point. “We’re finding that whereas in the past if you built the right relationships and had the right credentials there was an opportunity for the deal to be done on the day. Now, though, the business community is looking for a variety of quotes before signing.”

SatNav

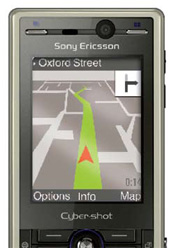

There are a number of specific markets in which resellers can make a mark. One of these is in satellite navigation. Increasingly this can be attached to mobile phones rather than standalone devices with applications such as Jentro, variously resold as Mymobilesatnav and GPS4Now.

The mechanism is simple; the customer downloads an application from the Jentro site (which will be branded according to which version of it you’re selling) and you also sell them a Bluetooth satnav unit with a charger. There is a clear opportunity to sell a compatible mobile phone if they don’t already have one.

They link the satnav unit to the mobile phone, put the phone somewhere visible and safe in the car and the satnav unit – which comes with a magnet – on the dashboard. The two communicate and it works like any other satnav unit, maybe even more accurately if our own tests are anything to go by.

The advantages to the customer are many. First the speed at which the dedicated satnav unit picks up a signal, which we found better than some mobile phones with a built-in unit (for example the Nokia N95, which is fine in many respects but handles satnav download only with average speeds). Second the customer can control the amount of data they download; the display can be set either to display a map or to show simple arrows and distances, which works out cheaper. Clearly the user’s phone needs to be compatible and they need a data package if they’re going to use the thing, which offer two means of making some margin.

Location based marketing

A wrinkle on satnav has started in the games market but is threatening to make its way into the business market. Mobile platform company Locomatrix in Brighton has developed a platform for games; the user downloads the games, buys a satnav unit and then plays the games using themselves as the player – so instead of going around a screen collecting fruit, for example, there’s a game called Fruit Farmer in which the player themselves has to go around a field and is told when they’ve reached the point where they’ve ‘picked up’ the fruit.

This is going to become useful for the business market in industries like tourism; imagine your customer being able to walk to a tourist spot and get a location-sensitive piece of tourist information when they stand next to a particular landmark. We’ve tried this in Brighton – it works, it’s fun and it needs a phone which can Bluetooth to the right sort of satnav unit. Used extensively it will also require a revision of the data package your client is buying.

Richard Vahrman, managing director of Locomatrix, agrees there is or should be an opportunity for people to sell the right sort of phones to make this sort of application work. “There would definitely be some opportunity for someone to bundle some specialised Loco games maybe with prizes as an incentive to use some of these services. Ultimately we would like to see new phones come pre-installed with our application and ready to play.”

Fleet management

Wireless fleet management is an area in which telecoms resellers can make a powerful difference. The current buzzword is ‘telematics’, which in the words of Charles Martin, chief marketing officer at wireless network group Wyless, means “the use of computers and telecommunications to enhance the functionality, productivity and security of both vehicles and drivers.” He points to research from ABI which states personal navigation and enterprise services will be worth $4.3bn ad $6.5bn respectively per annum by 2013.

The basics of telematics are straightforward enough. Someone tracks the vehicles and they can then be monitored for road usage and locations, including tracing stolen vehicles. Increasingly sophisticated applications mean it’s possible to perform remote diagnostics.

Getting the right system to a customer can be more tricky. “First it is important to clearly define your needs in terms of the accuracy level required from the system and the expected end results,” says Martin. “For example, does the organisation specifically want a solution to improve real-time visibility of all vehicle movements? Or to provide detailed data to benefit all areas of the business, from improved customer service to reducing fuel costs by targeting poor driving styles?”

As in so many business cases it’s about developing a professional relationship with a client when there’s a business need, and becoming their first choice of supplier. A reseller has an opportunity to add real value. “No matter how large or small the vehicle telematics providers are, they are all dependant on a communications partner to transfer the data/information to and from the vehicle, PC or machine, anywhere in the world,” says Martin, who naturally recommends his own company.

“As such, the communication partner should form an integral part of the buying criteria for an end user looking for a solution, or a telematics provider looking for a partner. If the data does not flow to/from the required destination, then the solution dies. Global, reliable and secure connectivity is needed.”

Wyless itself partners with fleet management companies like Enigma Vehicle Systems to offer this sort of telematics solution; there is every reason for switchedon resellers to familiarise themselves with this sort of application.

Remote management

|

| Phone-based satnav services don’t usually have the rich visual displays of standalone PNDs, but they are equally efficient and just as effective – especially for a business user. And it’s one less device to offer to the thieves. |

used to engage the customer, and potentially drive sales, being a targeted and intelligent way to engage in real time.”

This is of course more of a subtle sale; the end customer is massively unlikely to ask for a phone that enables someone to collect data on them. It’s an application, though, likely to drive a section of the market.

Mobile marketing is also becoming important. Swedish company Squace is active in the area and believes the user experience needs to be improved. “For Squace this is about creating a more friendly web interface because to this point the experience for most has been a poor one. To accomplish this we are simplifying the experience of importing links, creating customised sites and services specifically for mobiles,” says Aage Reerslev, CEO, Squace AB. “With usability improved it is our view that the ecosystem that fuels the industry (the channel, content providers and advertisers) will feel the positive impact of these advancements as users begin spending more time on the mobile web. Developments like this (both in technical and usability terms) will make it easier to earn money from a blog, a site or a service that is based on mobile users.”

Of course, it’s worth sanity-checking anything the analysts suggest about future buying patterns. Consumers might be interested in parking and location-based services on their phones but if you happen to be reading this magazine on a train, take a look around you. How many people are wearing earphones, listening to music or talking books or whatever their interest might be?

The best guess is ‘loads’, which rather gives the lie to the idea that the music and TV market is actually going away. Even here there’s likely to be blurring, though. Increasing numbers of organisations are using podcasts and vodcasts to communicate their messages to employees.

And the opportunities for the extras don’t automatically mean increased sales, as Advantage’s Jelfs points out. “If you’re able to hit all the hot buttons for your customer then you’re obviously in a strong position. If they come in and say they have a need for fleet management then you’d better be able to supply some sort of satellite navigation or fleet management, so it does open doors.” Professionalism remains important, he says, but other the competition is even more intense than before with manufacturers rather than the channel putting on some of the value-added software.

At this sort of stage, your correspondent ends up throwing his hands up in an almighty sulk – not because he disagrees but because he has a background in the data dealership press and was writing ‘it’s the relationship that matters’ as long ago as 1989.

In a way, though, that’s the whole point. No matter how much the press and other commentators might want to dress the various issues up and claim that the new data services are something revolutionary (they’re actually ‘opportunity to add value to a sale’ which Henry Ford might have thought of, had he ever added a free one-year service with every Model T) what matters is an understanding of your customer and the ability to anticipate their needs. It’s called professionalism and always has been.

And if you ask Mobile Business in a year or two’s time we’ll be saying exactly the same thing.

Take a look at some of the independent research around this subject. Juniper Research says the mobile Internet, driven by social networking and similar applications, is going to reach $22.4bn by 2013. Mobile Instant Messaging will be another one of the drivers, the company says, as will location based content services.

“Combining the power of the social network map – namely: ‘who I know, how I know and where I know’ – with that of mobility, presents the greatest opportunity for revenue generation of any of the applications as defined within Juniper’s Mobile Web 2.0 framework,” states Ian Chard, Juniper Research Analyst and author of the new report. “The phone is carried with us most of the time and contains a huge amount of personal data, making it a logical extension for the social network and a host of other collaborative Web 2.0 applications being mobilised.”

Looking a little less far ahead, Canalys Research also indicates that locationbased services are going to do well. “When asked which services they were interested in having on their mobile phone, whether for free or at a small ongoing cost, maps and navigation came top,” added Canalys analyst Daryl Chiam. “This was much more popular than having television or music on the phone, and these were some way ahead of services that are spreading out from use on the PC, such as web browsing, email and instant messaging. We find that, although consumer mobile application preferences can vary quite a lot by country, having maps, location and navigation information is usually at, or very near, the top of the list.” Finding a car parking space was one of the top ‘hits’ for the company.

This tells the reseller something very useful indeed – that the consumer and business markets may not end up as far apart in terms of their demands. More premium services will lead to a requirement for higher-end handsets and there’s a distinct possibility they may not be as different as all that – music and video for the consumer market and location specifics for the professionals sounds neat, cut and dried but it may not be.

800,000 phones were reported stolen in the UK in 2006.

Mobile infrastructure company Airwide is calling for further security and an Equipment Information Register (EIR) to become standard – once more, this is a factor of which mobile resellers can become aware and feed it into profits and indeed marketing.

“For retailers like CarPhone Warehouse, extensions to the EIR can offer valuable information that can be used to deal with the daunting challenge of inventory management,” says Terry McCabe, chief technology officer at Airwide.

“Using the device intelligence extensions of EIR operators can offer retailers valuable demographic trend information including the top device “make and models” used on an the network, the fastest growing device make and models on the network, rate of penetration of new devices and the rate of device turnover.

Armed with this information retailers will know whether or not handset is doing well and could discount it or take corrective measures to better move inventory.”